BST & Co. | Accounting, Business Advisory, and Management Consulting

REAL ECONOMY BLOG | December 05, 2023

Authored by RSM US LLP

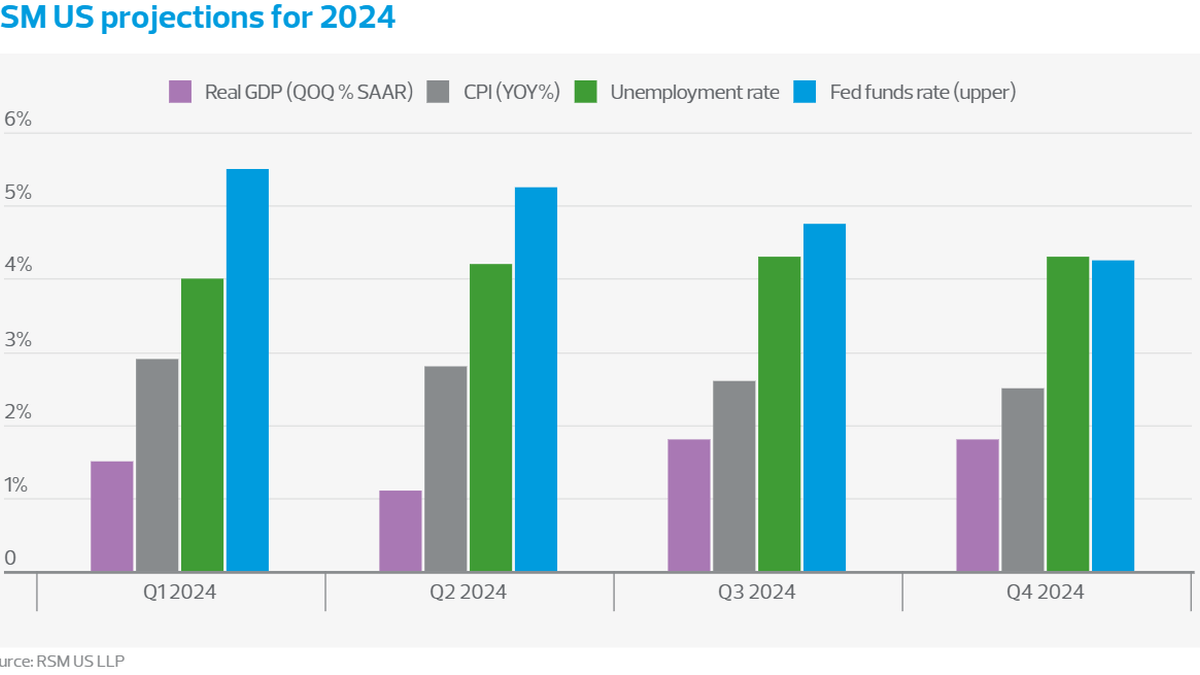

Solid consumer spending driven by real personal income gains and sustained private investment will underscore a steady pace of growth at or near the 1.8% long-run rate in the United States in 2024.

We expect that policy tailwinds from both the fiscal and monetary authorities will set the stage for strong productivity and growth in the years ahead as inflation eases back to a much more tolerable 2.5% to 3% range.

Most important, we are forecasting four 25 basis-point cuts in the federal funds policy rate starting in June, which would bring it into a range between 4.25% to 4.5% by the end of the year with risk of a lower rate.

The Fed’s cuts would come in advance of a maturity wall in corporate debt taking full effect in 2025, when companies will need to roll over their notes at higher rates compared to the five-year 2020 vintage.

For gross domestic product, our baseline forecast expects a modest easing in growth following the torrid 2.9% year-ago pace in the third quarter. Growth will then pick back up to at or above trend 1.8% in the second half of 2024 and possibly accelerate into 2025.

We forecast four 25 basis-point rate cuts by the Federal Reserve next year, starting in June.

Monthly job gains will slow to slightly below the 75,000 level that is necessary to meet labor demand, sending the unemployment rate up from the current 3.9% to a 4.3% cyclical peak. At the same time, inflation will continue to decline from the 9.1% peak in 2022 to 2.5% or lower by the end of 2025.

These two dynamics of robust employment and falling inflation will result in notable gains in real disposable income for American households and will be the difference between the solid expansion that we forecast and a more modest pace of growth closer to 1%.

One encouraging development this year has been rising productivity, which increased by 4.7% in the third quarter and averaged 4% during the previous six months.

With growth in the third quarter advancing at the robust 2.9% rate on a year-ago basis even as hiring cooled, productivity gains, and not necessarily labor, have been fueling these gains.

Our baseline scenario: 50% probability

In our baseline scenario, we anticipate that growth remains solid, continuing at or above the long-term U.S. growth trend of 1.8% even after the economy cools because of the impact of past rate hikes and the midyear backup in long-term yields. We give this scenario a 50% probability of taking place.

We think monthly hiring will cool to around the long-term level of 75,000 per month through the year. But as inflation eases, real wage growth will continue to improve, putting a floor underneath an economy that continues to adjust to a higher-for-longer price level and the rising yields across the maturity spectrum.

As the economy cools, we expect the Federal Reserve to bring down the federal funds rate by 100 basis points to stabilize long-term real yields and provide relief on borrowing costs for small- and medium-sized firms.

While we expect excess savings to be largely exhausted sometime in the first or second quarter of the year, we anticipate a modest increase in the unemployment rate to 4.2% and the expansion to continue.

Our upside scenario: 25% probability

In one of our alternatives to the baseline, the economy will prove to be far more resilient than expected, with growth approaching 2.5%.

The combination of excess savings, which we have estimated to be as high as $1.3 trillion, strong job demand and rising real wages amid soaring productivity will propel an unexpectedly strong U.S. economy.

Under this scenario, the major surprise will be the impact of large firms’ integrating sophisticated technology, most notably artificial intelligence, which will turbocharge output amid restrained labor costs.

Inflation during the last six months averaged 3.5%—well above the 2.3% between 2003 and 2013 and closer to the 2.8% average between 1993 and 2003.

With price stability returning, the Fed will hold off on any rate cuts until core inflation is back near 2.5%, most likely in late 2024 or early 2025.

Our downside scenario: 25% probability

In our third scenario, which we see as less likely, spending is pulled into the year’s final quarter amid the exhaustion of excess savings, a Fed policy error on hiking rates further and elevated borrowing costs. Those dynamics would create the conditions that tip the economy into a shallow recession in early 2024.

Under this scenario, weak holiday spending demand would create the conditions for an inventory correction that stimulates a greater-than-expected increase in unemployment and firms a pullback on software, equipment and intellectual property investments. Productivity gains, in turn, would slow back to or below the 1.3% trend of the past decade.

The Fed would then cut rates to offset a modest economic contraction as inflation moves back toward the long-run 2% target. Under this set of economic conditions, the Fed would start to cut the rate by 150 to 250 basis points during the first quarter to bring the federal funds rate down to the neutral level of 3% to 3.5% much more quickly.

Risks to the outlook

Our forecast that the economy will achieve a soft landing and avoid a recession could be upended by any number of risks. Here are four:

Rising interest rates across the spectrum: The primary domestic risk to the economic outlook revolves around how households and firms adjust to rising rates along the maturity spectrum, which we think will be one of the expansion’s defining features, if not the defining feature. In a relatively brief period, the Federal Reserve’s policy rate jumped from zero to 5.5%, and the 10-year benchmark Treasury yield pushed 5% before easing recently to near 4.5% in the middle of November.

The rising cost of just about everything, including financing durable goods, should curtail the robust average 4% increase in spending following the pandemic. Our recent RSM US Middle Market Business Index survey for the third quarter indicated that firms pay an average of 10% to 15% to borrow in credit markets and that 36% of firms have turned to the shadow financing market at these higher rates to finance business expansion.

Rates in that range are not sustainable. Should the Fed continue to hike its policy rate—an outcome we think is highly unlikely—then risks to the expansion will increase. In addition, local and regional banks with unrealized losses could face another round of financial stress. In addition, more than $3 trillion in corporate debt will need to be rolled over in the coming years. The notes issued in 2020 and 2021 at low single-digit rates will almost surely be rolled over at high single- or double-digit rates. The higher rates will shadow growth prospects later in 2024 and define the outlook for 2025.

Energy markets: Second, geopolitical tensions in the Middle East linked to oil prices are the other risks on the table that could derail the current business cycle. As long as the conflict between Israel and Hamas does not widen to include Iran, we do not expect anything other than short-lived bouts of volatility in oil markets.

China’s debt: Third, the debt and deleveraging cycle underway in China—it takes seven to 10 years for an economy to move through the debt and deleveraging cycle—drags down overall global economic demand and could cause notable economic problems in East and South Asia. At this time, we do not see global systemic risks because of China’s deleveraging. But it requires close monitoring, given the significant role the Chinese play in global demand for commodities.

Political polarization: Finally, we think the upcoming election year presents unique challenges to the outlook. Political polarization is so extreme that it now adds a measure of potential volatility to economic activity. We do not anticipate any fiscal consolidation during the upcoming year as the country approaches the presidential election. Beyond that, we do not expect any significant federal legislation that will get done that adds or subtracts to the fiscal and economic outlook next year.

Interest rates

Our economic forecast for 2024 implies that the United States has reached the cyclical rate peak and that a modest easing over the next 12 months is likely.

We expect the Federal Reserve to reduce the policy rate by 100 basis points to a range between 4.25% and 4.5% by the end of the year and down to 3% and 3.5% by the end of 2025. We are forecasting a rate of 4.5% in the 10-year Treasury, which compares favorably with forward dollar swaps markets pricing at a 4.4% rate in 12 months.

Longer-term interest rates are the present value of short-term rates plus compensation for the risk of holding those long-term securities to maturity—the so-called term premium. The Fed’s setting of its overnight policy rate drives the bond market and, in turn, the willingness to borrow or lend and the level of demand and economic activity.

When the policy rate was at zero, bond yields were compressed across all maturities. There was negligible risk in borrowing or lending as 10-year yields traded below 2% during the recovery from the financial crisis and below 1% during the health crisis.

With the cost of capital compressed at near zero, that implied that the predominant risk in the bond market was the risk of economic collapse and deflation. That risk is characterized by the decline and negative values of the term premium from 2009 until the government’s capital infusion during the pandemic.

More recently, the yield on the benchmark 10-year Treasury bond has continued to respond to the perceived changes in Fed policy. With the federal funds rate at 5.5% and far off the lower bound of zero, a wider range of trading and risk associated with bond trading exists.

That increase has pushed the term premium above zero for the first time since 2021, which is a healthy sign for the bond market and an economy able to support higher interest rates.

Because of structural changes in the American economy, we think 3% represents a new floor in the policy rate.

Long-term interest rates should settle between 4.5% and 5%, with the risk of modestly higher rates going forward and implying a bond yield rate near 6%. We think this implies 30-year fixed mortgage rates hovering between 5.5% and 6%, with builders buying down mortgages to address affordability issues among potential buyers.

Already in November, homebuilders were buying down mortgages on new home purchases between 4.5% and 5.5%, and we would not be surprised to see that range become the sweet spot for purchases.

Long-term yields are less likely to move above 5% because of the growing demand for consistent and safe returns of buy-and-hold strategies in the bond market. The domestic demand for Treasurys and higher-yielding U.S. corporate bonds will be augmented by the demand for U.S. securities by foreign investors who seek safe-haven investments augmented by the currency return of a strong dollar relative to their domestic currency.

The U.S. dollar

We expect narrowing interest-rate differentials with the major U.S. trading partners to pressure the dollar lower in the first months of 2024.

We then expect that robust U.S. growth and the opportunity to invest in real assets, spurred by American industrial policy, will drive valuations of the U.S. dollar higher compared with other developed economies. That will work to maintain the dollar’s 15-year uptrend.

The course of U.S. interest rates is as important for the global economy as it is domestically. The 10-year Treasury yield is the benchmark for the global bond market, with short-term U.S. securities facilitating global trading of goods and financial assets and the determination of the dollar’s value.

As with all commodities, a currency’s value is set by the supply and demand for that currency. The intrinsic demand for dollars comes from the high regard for U.S. institutions and the guarantee of payment.

Despite the domestic fiscal austerity and political distortions that have continued since the financial crisis, the dollar has increased in value over the past 15 years, both in nominal and real terms.

We expect the dollar to retain its underlying value for as long as the U.S. economy continues to grow and for as long as U.S. interest rates are higher than those of its trading partners.

While a stronger dollar lessens the cost of foreign goods for American consumers and pushes down on inflation, a stronger dollar at the same time makes inflation worse for foreign buyers of dollar-denominated goods and services. This is particularly true for nations that are dependent on foreign supplies of fossil fuels.

Changes in the value of the dollar are in part because of interest-rate differentials with other currencies. Investors will put their money in places with the highest return.

Fiscal policy

It is clear that the U.S. fiscal path is unsustainable. While the economics and finance around supporting the direction of fiscal policy are not in doubt, it is going to be an ongoing source of risk because of the differences in political philosophy between the two governing parties.

Moody’s recent downgrade of the U.S. credit outlook from stable to negative while retaining the Aaa credit rating will surely be part of the policy, economic and financial narrative going forward.

While the U.S. continues to issue debt without any disruptions to the functioning of financial markets, at one point, it will require severe cuts or tax hikes that bring in more revenues, a revamp of the current tax system or all of the above to put the fiscal path on a sustainable basis.

The economics community has long understood that it is a good idea to restrain the level of growth in spending over the medium term to below the rate of growth in the economy. Focusing on bringing down the primary deficit, which excludes interest payments on past debt, will result in lower borrowing costs over the medium to long term.

Fiscal policy by Congress should be understood as a complement to monetary policy. As we have observed during the recovery from the pandemic, an aggressive fiscal policy (as opposed to austerity) in conjunction with a tight monetary policy is a positive for the dollar. It can function as a magnet for foreign direct investment.

The economics and finance of debt and deficit dynamics are not an issue right now. In fact, the smart use of fiscal policy to invest in the economy’s future is working to crowd in rather than crowd out private investment.

This article was written by Joseph Brusuelas, Tuan Nguyen and originally appeared on 2023-12-05.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/u-s-economic-outlook-expansion-continues-into-2024/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

BST & Co. is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how BST & Co. can assist you, please call (518) 459-6700.