Resource Center

Categories:

Industry:

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Credits and Incentives

- Data Digital Services

- Digital Transformation

- Employee Benefit Plans

- Federal Tax

- Financial Consulting

- Financial Management

- International Tax Planning

- Managed Services

- Managed Technology Services

- Private Client

- Private Client Services

- Risk Advisory

- Risk Consulting

- State and Local Tax

- Tax

Topic:

Death and taxes: Critical opportunities for nonprofits

With the American population aging, postmortem contributions are critical opportunities for nonprofits to receive charitable contributions

The IRS urges businesses to review ERC claims for 7 common red flags

IRS urges employers to review ERC claims before the Voluntary Disclosure Program deadline of March 22, 2024. The agency warns of 7 common signs ...

Deadline for filing 2023 forms 1099 is near but beware of important changes

New electronic filing requirements, revised form 1099-NEC and new form 15397 present addional challenges for 1099 filers that may necessitate updates

Tax framework agreement sets direction for potential business and individual tax relief

Section 174 expensing, a return to EBITDA for section 163(j), an extension of 100% bonus depreciation and disaster relief paid for by ending ...

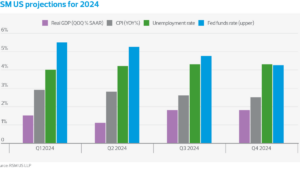

U.S. economic outlook: Expansion continues into 2024

Expect the economy to settle into its long-term growth rate of around 1.8% next year. Read our forecasts for growth, inflation, unemployment, ...

OMB proposes changes to Uniform Guidance

The Office of Management and Budget (OMB) has proposed changes to Uniform Guidance that will affect government contractors.

What to do if you filed an employee retention credit claim with the IRS

ERC submissions are under scrutiny by the IRS due to a surge in questionable claims. Are you confident your claim meets the eligibility ...

IRS halts employee retention credit processing

The IRS has temporarily halted processing of employee retention credit claims and will provide additional guidance for businesses.

2023 consumer goods industry outlook

In our 2023 consumer goods industry outlook, we explore what's ahead for middle market business leaders.

2023 Federal grants management update

Join us for our 2023 federal grants management webcast on August 29.

Unraveling financial reporting changes: GASB 96 and its impact on SBITAs in the middle market

This webcast will delve into the details of GASB 96, the subscription-based information technology arrangements (SBITA) standard.

Automate and elevate: Driving business value to new heights

Automation solutions that improve operational efficiency and the client and talent experience.