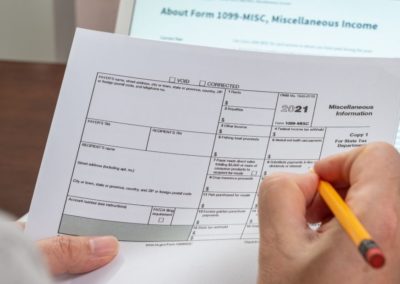

Test Your 1099 Knowledge

Basic 1099 Filing Requirements 2021

Ron Guzior Interviewed on Outsourcing for Small Business

IRS releases guidance on Q4 removal of employee retention credit

Albany Business Review interviews Ron Guzior and Gary Sancilio About Forming a New Company

Family office constitution: A governance framework built to last

IRS releases guidance on timing of tax-exempt income for PPP loans