Resource Center

Categories:

Industry:

Service:

Topic:

Federal tax planning: A guide for tax year 2024

A U.S. federal tax planning guide for businesses for tax year 2024, including M&A tax planning and ASC 740 tax planning strategies.

2024-25 annual tax planning guide for individuals and families

A tax planning guide for individual income tax planning and family tax planning strategies at 2024 year-end moving into 2025.

Evaluating PTET elections in a post-SALT cap world

Effects of the PTET election after the SALT cap expires and weighing the PTET against full deduction and AMT considerations.

Death and taxes: Critical opportunities for nonprofits

With the American population aging, postmortem contributions are critical opportunities for nonprofits to receive charitable contributions

The IRS urges businesses to review ERC claims for 7 common red flags

IRS urges employers to review ERC claims before the Voluntary Disclosure Program deadline of March 22, 2024. The agency warns of 7 common signs ...

Deadline for filing 2023 forms 1099 is near but beware of important changes

New electronic filing requirements, revised form 1099-NEC and new form 15397 present addional challenges for 1099 filers that may necessitate updates

Tax framework agreement sets direction for potential business and individual tax relief

Section 174 expensing, a return to EBITDA for section 163(j), an extension of 100% bonus depreciation and disaster relief paid for by ending ...

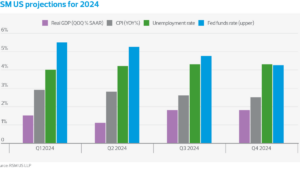

U.S. economic outlook: Expansion continues into 2024

Expect the economy to settle into its long-term growth rate of around 1.8% next year. Read our forecasts for growth, inflation, unemployment, ...

OMB proposes changes to Uniform Guidance

The Office of Management and Budget (OMB) has proposed changes to Uniform Guidance that will affect government contractors.

What to do if you filed an employee retention credit claim with the IRS

ERC submissions are under scrutiny by the IRS due to a surge in questionable claims. Are you confident your claim meets the eligibility ...

IRS halts employee retention credit processing

The IRS has temporarily halted processing of employee retention credit claims and will provide additional guidance for businesses.

2023 Federal grants management update

Join us for our 2023 federal grants management webcast on Aug. 29.

No results found.