Resource Center

Categories:

Industry:

Service:

Topic:

Basic 1099 Filing Requirements

If your trade or business made payments in 2022, you are most likely required to file information returns to the IRS (Forms 1099-NEC, 1099-MISC, ...

10 Accounting Terms Explained

Understanding accounting jargon is important to avoid misunderstandings and costly mistakes. We provide 10 examples of accounting jargon ...

Simplifying the New Lease Standard

The new lease accounting standard is effective for fiscal years beginning after December 15, 2021 for nonpublic organizations; so it’s essential ...

Small Businesses May be Eligible NY Tax Credits for COVID-19 Expenses

Eligible small businesses can receive a tax credit of 50% of qualifying expenses up to a maximum of $25,000 in tax credits on qualifying ...

Why You Must Keep Your Eyes on KPIs

Key performance indicators, or KPIs, are critical tools to monitor business health. With Sage Intacct, you can measure and visualize customized ...

Must-Know Facts About Business Financial Fraud

Business financial fraud is a concern for most businesses. We detail common fraud schemes and offer tips for avoiding and recovering from fraud.

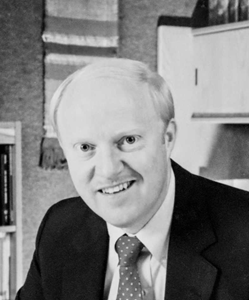

The passing of Founding Partner Richard Owen Bollam

It is with heavy hearts that we share the sad news of the passing of BST & Co. Founding Partner Rich Bollam, who died peacefully on Wednesday, ...

Cash vs. Accrual Accounting: Which Is Better for Small Businesses?

Small businesses need to understand the differences between cash-basis accounting and accrual-based accounting to determine which method will ...

Get Back Up!

The image of Mikaela Shiffrin sitting on the sidelines after skiing off course and not completing her second competitive race at the 2022 ...

Taxing Remote Work—What You Need to Know

What taxes do remote workers and their employers need to worry about? It varies by state, but New York is especially active in collecting state ...

Income tax, charity and estate planning strategies for digital assets

Considering the income tax, charity and estate planning implications of digital assets, such as crypto, can minimize tax burden, comply with ...

Planning ahead for 2023 Taxes with Kim Wright

Partner Kim Wright shares tax advice for how to plan for 2023. Listen in on her tips. They might save you time and money.

No results found.